Bad Debt Written Off Double Entry

Now as provision for bad debts 2 on debtors is to made. For example company XYZ Ltd.

Bad Debt Overview Example Bad Debt Expense Journal Entries

Get a Savings Estimate.

. Write-Off can be defined as the process undertaken by accountants to remove a specific asset from the financial statement. 1000 from Ms KBC as bad debts. Debit bad debt provision expense PL 100.

The following journal entry is made for this purpose. Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors Name. In sight of accounting when a business has got an unpaid debt by the customers or clients we will use the following entries.

Z as uncollectible with a balance of USD 350. Bad debts are uncollectible invoices that are written-off from the accounts. You can write off this bad debt and classify it as a business expense as opposed to income.

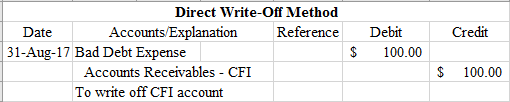

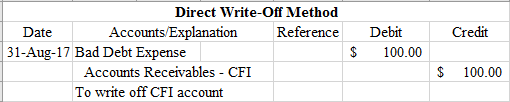

Solve Study Textbooks Guides. A bad debt can be written off using either the direct write off method or the provision method. 1 The original double entry when the Company billed customer A is.

Accounting entry required to write off a bad debt is as follows. When it comes to VAT you may claim back any VAT youve already paid the HMRC on this bad. D by debiting the 800 into accounts receivable and crediting the same amount into the.

Debit Bad debts 500 PL Credit Receivables account 500 BS This entry will directly affect both the. Bad debts written off. Ms X should write off Rs.

Decides to write off one of its customers Mr. In this case the company ABC needs to make two journal entries for this bad debt recovery of Mr. From this amount the company can.

The double entry will be recorded as follows. The following accounting double entry will be passed in the books of the company. The double entry would be.

Trade Debtor Balance Sheet 10000. Bad debts written off CR. Answer 1 of 4.

Note that the provision for bad debts on 31122017 is Rs. This is primarily resulting from the underlying need to record the. Bad Debt Expense.

After this double entry the remaining balance in accounts receivable will be 90000 100000 10000. Notice that this entry is exactly the reverse of the entry that is made when an account receivable is written off. Bad debt is a loss for the business and.

Any company that has a policy of selling goods on credit has to deal with the problem of bad debts. Give journal entry for. Please provide the journal entries to be made for bad debt.

As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10. August 21 2022. The first approach tends to delay recognition of the bad debt.

We use the allowance method to deal with bad debt so the net book value of their accounts on the balance sheet is already zero. Already has 7000 in the provision for doubtful debt accounts from. Ad Free Independent Reviews Ratings.

View solution View more. Credit Bad provision 100 BS. It means we have to make new provision.

In this case we can make the journal entry for this 50000. Accounts receivable 10000. Revenue Income Statement 10000 2 Next the Company.

Give journal entry for. This estimate of 1000. If however we had calculated that the provision should have been 400.

Here provision for bad debts for last year is given in trial balance is given.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

Allowance Method For Bad Debt Double Entry Bookkeeping

Writing Off An Account Under The Allowance Method Accountingcoach

Writing Off An Account Under The Allowance Method Accountingcoach

Writing Off An Account Under The Allowance Method Accountingcoach

0 Response to "Bad Debt Written Off Double Entry"

Post a Comment